Mobile local ad network xAd just released its Q4 Mobile Insights Report, detailing the activity seen on its network. Like its Q3 report (covered here), it further supports the growth and the opportunity in mobile local search.

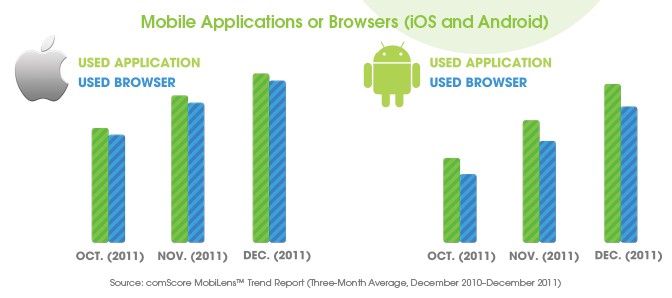

XAd, for those unfamiliar, hangs its hat on in-app search and display ads. That’s opposed to browser-based search where Google dominates. As we discussed at ILM West, in-app search has a greater opportunity because of its growth and fragmentation (read: lack of Google dominance).

To the former point, xAd points to comScore data that show apps have greater overall use, compared with mobile Web (browsers). That’s not necessarily correlated to more searches but could be a leading indicator for the growth in search volume happening in-app.

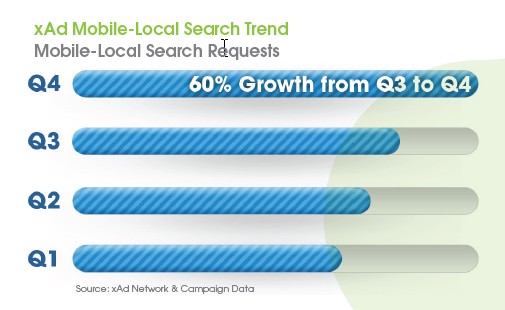

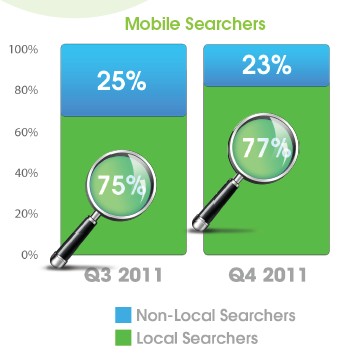

Overall, xAd delivers a billion locally targeted mobile search and display ads across its network. From that it’s seen a 60 percent increase in mobile local search requests over Q3, supporting some of our forecasting for the growth of local. The number of searchers has also increased.

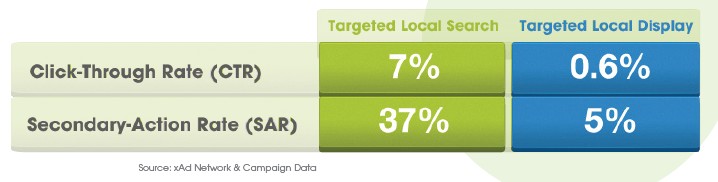

Also notable, and along the same lines, xAd reports strong performance for mobile local ads (compared with online equivalents). Specifically, search ad CTRs were 7 percent and display saw 0.6 percent. High secondary action rates further support mobile local ad performance.

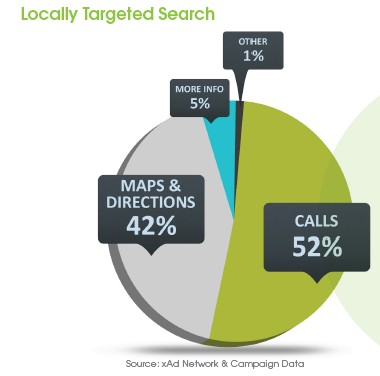

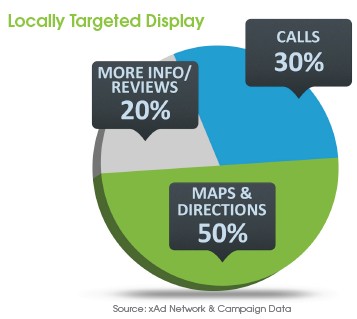

These secondary actions are what lots of advertisers are looking for, particularly bottom of the funnel advertisers (i.e., calls, directions, etc.). This has long been one of the battle cries for mobile advertising and its ties to local commercial intent, but proven out here.

Along those lines, search (interestingly but not suprisingly) had greater portion of calls and directions, while display ads were strong in leading to reviews. That fits the intent driven nature of search versus the discovery mode of display (discover places you haven’t been).

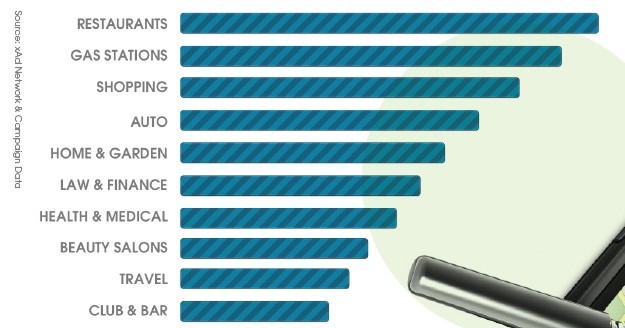

Other general data included category, geography and daypart breakdowns. Consistent with what we see elsewhere, restaurants were the leading category for local search, followed by high immediacy categories like gas and shopping (bars were curiously low on the list).

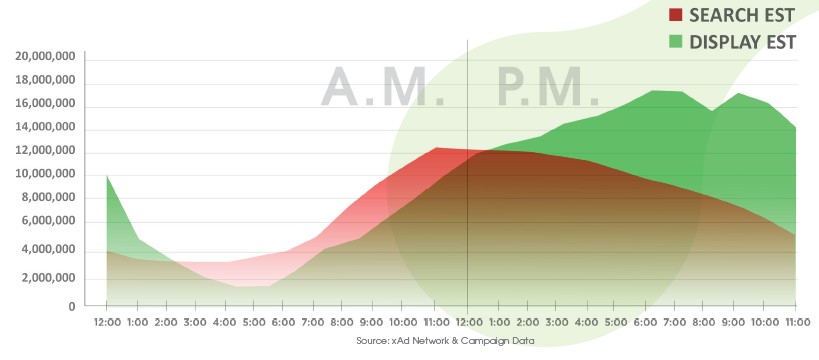

But the daypart breakdown was more interesting for revealing incremental distribution opportunities for display and search ads. Their respective daily peaks vary between late morning (search) and evening (display), signaling lots of tactical implications for mobile ad campaigns.

There are lots more implications buried throughout the data, which we’ll save for a longer report … and longer conversations during ILM East and other upcoming conferences. More will also be in our fresh mobile ad forecast next month. We’ll keep you posted on all of the above.

This Post Has 0 Comments