AirBnB, the home and apartment on-demand rental service, said yesterday it will lead a $13 million investment in Resy, a New York-based restaurant reservation service founded by entrpreneurs Gary Vaynerchuk, Ben Leventhal and Michael Montero. All have deep online marketing experience that can help AirBnB bundle local dining experience with its existing travel booking business. The question we want to ask today is, does Resy have the resources to capture a significant share of the dining reservations business in partnership with AirBnB?

Undoubtedly, AirBnB has a massive advantage in its existing customer base, who are likely to welcome an app for finding meals near where they are staying. AirBnB has raised $2.95 billion in funding to date. It can buy television and has spent heavily on Google ads to win customers away from hotels. It raised host fees by 12 percent to 15 percent in October 2015 to support increased Google spending.

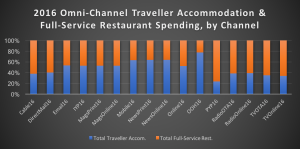

But the scope of marketing spend in the full-service restaurant space is virtually the same size as the room and house booking business. We took a look at 2016 spending in the top 50 markets across 16 media channels in Traveller Accommodations and Full-Service Restaurant advertising in BIA/Kelsey’s Media Ad View database. Last year, travellers were exposed to approximately $2.88 billion in advertising across cable, broadcast, newspaper, online, email, direct mail and other channels. Full-Service restaurants spent an additional $2.82 billion in the same markets. (See Figure 1)

AirBnB can leverage its existing engagements with travellers to encourage use of Resy while travelling. We can allocate to Resy a 20 percent adoption advantage over an reservations startup without a strategic partnership. In other words, we believe Resy will convert roughly 20 percent more customers to using its app using the same budget as an independent competitor. However, Resy’s success cannot rest entirely on that advantage.

Figure 1 clearly shows that the restaurant advertising market is more competitive than traveller accommodations in many channels. In order for Rezy to displace well established reservations apps, such as OpenTable, it will need to allocate much more than the $15 million it has raised to date for marketing spend. These early-stage investments will give master marketer Gary Vaynerchuk the opportunity to build adoption momentum, but gaining a market position comparable to AirBnB will require a minimum of $100 million in local channel spend to: 1.) Make Resy discoverable by travellers, and; 2.) Make AirBnB hosts and customers associate Resy with travel.

Resy can help AirBnB consolidate its share of traveller wallet. It has a secondary opportunity in the managed services market, which the National Restaurant Association said its members spent $50.9 billion in 2016. Both targets make this a savvy investment by AirBnB. Both goals are going to cost Resy and AirBnB a significant marketing investment to gain real dominance over existing and emerging competitors.

This Post Has 0 Comments