Clearly, the radio industry got shocked today with the announcement of Entercom and CBS Radio being combined into one company. For several months, the prospect of CBS Radio as a separate public company through a new IPO has led many to consider the potential dynamics of the radio industry as it moves forward facing new competition. Now, in light of the news, the dynamics are quite different.

What has emerged (assuming the deal goes through and gets regulatory approval) is a stronger radio industry. The combined Entercom-CBS Radio group would be closer to the size of the industry leader – iHeart Media – which only can foster the radio industry’s ability to compete against its many new competitors.

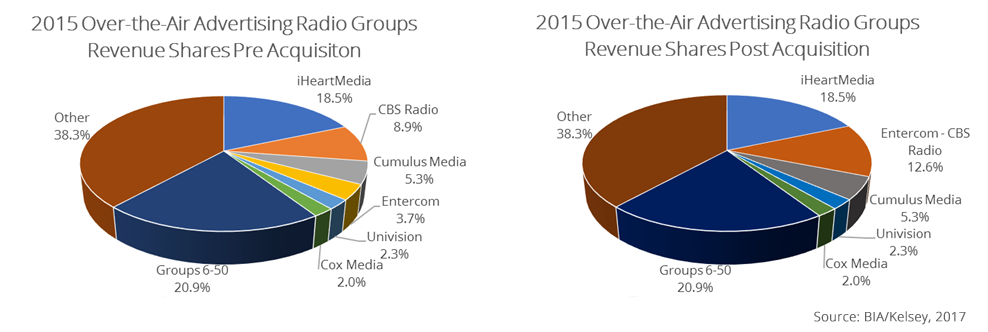

Here’s how the revenue landscape will be changed by this merger. Below are the shares of the major radio groups, pre-and post-acquisition, according to BIA/Kelsey’s estimated revenues. Where CBS Radio was more than 50% lower than iHeart, and Entercom was over 66%, in terms of over the air advertising revenue, now the combined company is only approximately one-third lower.

While the total share has increased, it is important to realize that in the local markets, the markets in which these stations compete, the competitive outlook has not changed much. Of course, the combined company will have to divest itself of some stations in markets where they exceed the present local ownership caps – Los Angeles, CA, San Francisco, CA, Boston, MA, Seattle-Tacoma, WA, San Diego, CA and Sacramento, CA. But, in most markets there is little, if no overlap. The competitive outlook in those markets will remain the same except that the name of the parent company will be different and that parent company will be stronger to invest and compete.

Perhaps this combination was inevitable. While it is striking that CBS no longer will own radio stations where they have owned radio stations for nearly a century, it is more indicative of the new environment in which radio stations find themselves. More competition for listeners and more competition for advertisers has led to many changes to the industry. This combination is just another one of those changes.

This Post Has 4 Comments

Leave a Reply

You must be logged in to post a comment.

CBS is giving the radio division to Entercom on the cheap. Why else would they take what nobody else wants? Entercom just acquired a historical mansion with termites. Once consummated Entercom will join in the infestation — an onerous FCC ordered compliance agreement for the Sponsorship sins of CBS past — “polarizing” shareholders.

Purchase price going to be far south of the $2.7 billion estimated value of the group. Unlike the compliance order and FCC Sponsorship fine Cumulus took on when it acquired stations last year, CBS’s (WFAN 660 NY) Sponsorship violations are not mere technicality but blatant payola on a political issue. Entercom must be banking on Enforcement Chief Travis Leblanc’s resignation to dull what otherwise would have been an eye popping fine. Regardless, the new Republican administration at the FCC is going to have to whack CBS and now Entercom’s 244 stations with an onerous and expensive compliance order. This is bad news for an industry that was already facing declining revenue. Expect massive cost cutting measures across the board to combat the increased compliance costs. Despite the recent rise in Entercom shares, this revelation will ultimately send a wave of buyer’s remorse over the bow of Entercom shareholders.

Michael Carowitz may not be Travis Leblanc but don’t think it is coincidence that Entercom shares have already given back their gains from the initial excitement surrounding CBS merger. Buyers remorse?

The Entercom/CBS arm of the NAB may well have suppressed the blatant Payola/Sponsorship violations at WFAN allowing their combination. However, nothing can stop the NYC civil suit on for 11/20/2017 delineating the fraud perpetrated on the nationally syndicated audience of WFAN’s Boomer and Carton Show. Nor can anything stop the flood gates of libel and invasion of privacy suits Entercom now owns with this combination. Any of the scores of individuals personally named in the scandalous never vetted self published tell all that Sid Rosenberg thrice promoted on the FAN in August 2014 can take a bite out of Entercom’s once healthy balance sheet turning it blood red. Caveat Emptercom! Your shareholders have been “Polarized”! CVA! Kevin DeBlasi, Esq.