JPMorgan Chase & Company’s Local Consumer Commerce Index analyses 20 billion transactions by 60 million Chase credit and debit card holders in 15 metro areas. Its most recently released report shows an overall 1.0 percent growth (June 2016 vs June 2017) but this varies widely by metro area, by consumer segments, and by product categories within each metro. Each metro has its own local story that marketers would do well to analyze and understand. Among other insights, the data reveal consumer shopping behavior by comparing where they live versus whether their purchases are made at businesses in their neighborhoods, inside their metro or outside their metro area.

The local stories differ widely in some cases. For example, Seattle shows consumer spending down -7.3 percent while Denver is up +9.1 percent in consumer spending. Local consumers from the same neighborhood as the business where they made purchases in Seattle spent 1.5 percent more but consumers from outside the region spent -32.8% less. Older Seattle consumers spent less overall and nondurable products and large businesses faced the biggest declines. In Denver, it’s actually out-of-region consumers showing the greatest spending growth (+37.3 percent) compared to consumers in the same neighborhood (+3.5 percent) or same region (+3.5 percent). Consumers under 25 years (+31.0 percent), purchases at large businesses (+20.1 percent) and purchases of “other services” (i.e., not durables, fuel, nondurables or restaurants) showed the greatest growth at 35.7 percent.

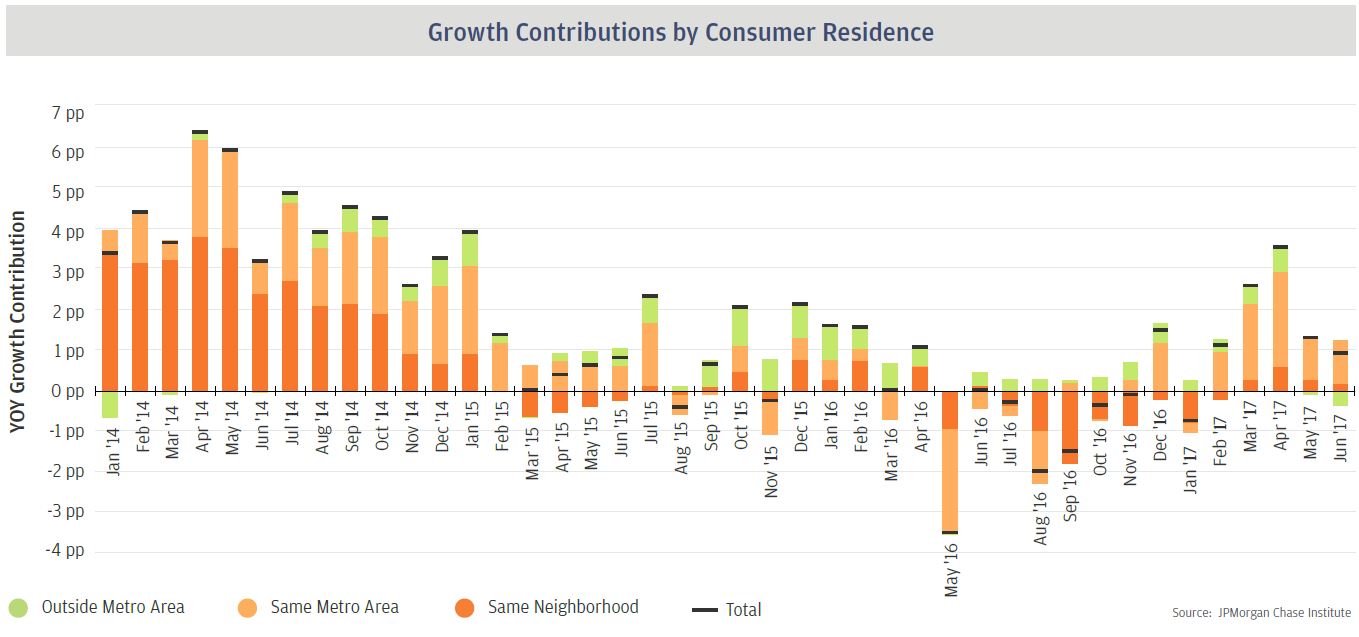

There’s an interesting in the data series as we observe in the chart below. Through the first three quarters of 2014, the biggest year over year growth in consumer spending was by consumers spending at businesses in the neighborhoods where they lived. However, in the first two quarters of 2017, the biggest growth segment was consumer spending at businesses in the same metro area. Purchases outside the metro area actually saw negative growth in May and June 2017. Factors that could drive these results might include budget conscious consumers doing less travel; perhaps more competitive and effective target marketing by businesses metro-wide enticing consumers out of neighborhood shopping destinations; looking at the large dips in 2016, simply a rebound from an off year.

The JPMorgan website hosting this research provides the ability to download some of the data and interact with maps and data visualizations.

This Post Has 0 Comments