BIA Advisory Service’s released our latest report in the advanced TV series, Advanced TV and Innovation in Local Markets. To dig into the current marketplace trends and get informed views about what the leading indicators are and what we should expect to see, we’ve interviewed top executives from Imagine Communications, IRI, iSpot, Operative, Sinclair Broadcast Group, and Videa to get their points of view.

Generally, we’re seeing steady progress for linear TV’s prospects in the national TV market for advanced TV as more data, targeting, and innovative types of inventory get introduced and better supported. On the local TV market side, we see continued innovation and adoption of advanced TV solutions. But the local TV market lags certainly lags adoption of advanced TV services in the national TV market.

As we look ahead to the ad revenue future for local TV, BIA forecasts total spending to grow from $19.3 billion in 2017 to $22.9 billion in 2022. Of course, we see the even-year rises and odd-year softening due to political and Olympic spending cycles. Overall, we see a lot of absolute spend going into local TV in our forecast period.

However, we don’t see a lot of upside for organic growth in local TV. Even on the digital side, and here we mean assets like owned and operated websites and mobile apps, we don’t see very meaningful growth for TV relative to the rest of the digital ad world.

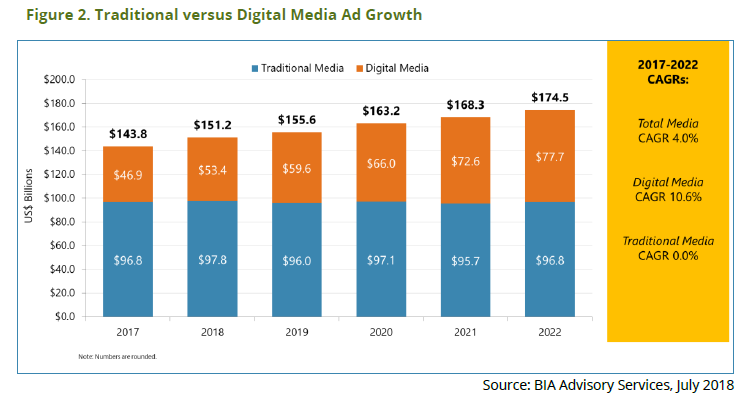

The fact is, most of the overall growth in local ad spending to be in the digital media channels. Digital media will increase from $46.9 billion to $77.7 billion by 2022 according to our forecast. Traditional media as a group hold at about $96 billion. Local TV can’t growth much by competing with other TV stations.

This all begs the question, where and how can local TV achieve significant growth? Significant growth comes only from being more competitive with digital ad platforms.

This Post Has 0 Comments