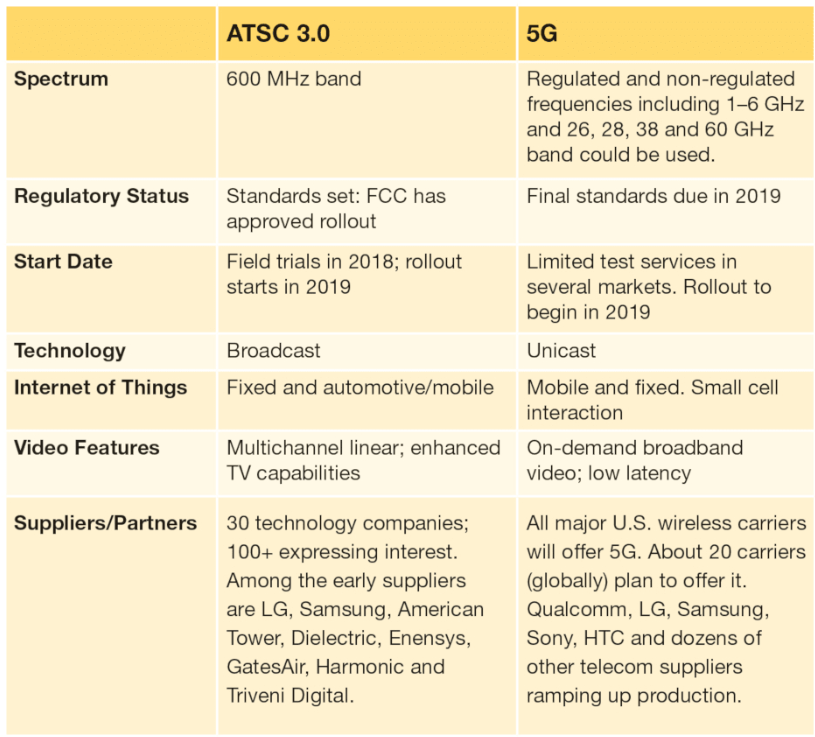

As the graphic presented above (from a recent TV Technology article) highlights, ATSC 3.0 and 5G deployments, capabilities, and industry commitments are running on similar timelines. The local TV industry is ramping up its testing and deployments of its NextGen platform, ATSC 3.0, and “enjoying” all the complexities and opportunities inherent to this roll-out.

At last week’s BIA Local Impact event in New York, Spectrum Co.’s John Hane provided an update of how its consortium members are looking to develop service and revenue opportunities outside the typical broadcast TV business models as incremental to the exciting news kinds of higher quality, audience targeted, and mobile-first services this new platform supports. One new market opportunity for local TV’s next gen platform is the Connected Car. Its new mobile-first and native Internet Protocol services capabilities are compelling for ATSC 3.0 in this space. The connected car market has been the province of 4G cellular technology, and that platform is aging out. Much more capable 5G networks are rolling out. ATSC 3.0 can add significant value in specific ways into what may become a hybrid 5G and ATSC 3.0 network environment and services provided to connected cars.

The 2018 NAB Show highlighted a demo of, “The first time an autonomous vehicle and Next Gen TV have been combined to provide a powerful glimpse of the future,” according to NAB Chief Technology Officer Sam Matheny. “Riding in a driver-less vehicle is a revealing moment for people to see where the future of mobility is taking us, and viewing live HD broadcasts while doing so really highlights one of the great opportunities that broadcasters have in deploying the ATSC 3.0 standard.”

It’s interesting to consider the juxtaposition of ATSC 3.0, local TV’s next gen platform and the concurrent roll-out of 5G, the wireless industry’s own next gen platform. A lot is at stake. A 2018 study released by CTIA estimated that U.S. leadership in 4G led to a $100 billion increase in GDP by 2016, an increase in wireless related jobs by 84 percent, $125 billion in revenue flowing to U.S. companies, and $40 billion in additional app store revenue. As the U.S. transitions its wireless systems to 5G and ATSC 3.0, that’s the potential magnitude of the the economic impacts. If local TV broadcasting can indeed become part of 5G/ATSC 3.0 hybrid networks and related services, the outcomes for consumers, business, and public service are very promising.

ATSC 3.0 and 5G hybrid deployment is becoming an increasingly compelling topic for local broadcasters, as highlighted in a recent TVNewsCheck article, ATSC 3.0 and 5G: Adversaries or Collaborators? ATSC’s Mark Richer told TVNewsCheck, ““We think ATSC 3.0 could become part of a 5G ecosystem. The flip side is true also, that 5G networks could become part of the broadcast television system.” Another article by TV Technology’s Gary Arlen observed that, “Advanced Television Systems Committee officials demonstrated how — in addition to traditional over-the-air broadcasting — ATSC 3.0 could also be used for telematics, infotainment and other services involving connected cars and autonomous vehicles . . . The idea of using a broadcast standard for such uses is revolutionary but it’s anticipated that the emerging 5G wireless standard will be the dominant method for communicating with autonomous vehicles. On the other hand, the vastly increased bandwidth of 5G will give wireless carriers the ability to greatly expand their video offerings.”

The Connected Car ecosystem offers a compelling new market opportunity where local TV broadcasters may be able to achieve significant revenue growth. This market has multiple dimensions leveraging location intelligence, data, information, entertainment, and more. Announcing their partnership in next generation solutions for the self-driving era, LG Electronics and HERE technologies define this telematics market as, “an industry that is defined as the integration of telecommunications and informatics to provide vehicle safety and entertainment services such as navigation, location confirmation and emergency dispatch through various communication technologies, from GPS and DMB (Digital Multimedia Broadcasting) networks to Bluetooth, Wi-Fi and mobile communication.” There’s a lot of inherent opportunity for local TV implied by this vision of telematics and the connected car and where ATSC 3.0 can take its next gen platform and services.

Part of 5G’s infrastructure requirement is that thousands of new small cell sites need to be installed, perhaps as many as 300,000 nationwide, according to CTIA. That involves a lot of state and local government in the process, not exactly an expedient in the process. FCC Commissioner Brendan Carr expects that, “over 90 percent of 5G investment will be in rural and suburban areas.” Carr’s in favor of reducing this burden on the 5G industry. And in fact, the FCC just decided to preempt local governments to speed 5G’s roll-out. This could be an opportunity for 5G/ATSC 3.0 collaborations. One example of a potential 5G and ATSC 3.0 business collaboration could be in rural and suburban areas. Hybrid 5G/ATSC 3.0 networks serving the needs of a Connected Car marketplace could bring next gen services faster and more economically to the country’s non-urban markets.

There’s a flurry of activity in both 5G and ATSC 3.0 roll-outs, both set to reach prime time in just the short years ahead. However, it’s not the just the work around 5G and ATSC 3.0 that will be consequential in targeting the Connected Car market. It’s also understanding different tech standards in play within the Connected Car market. As the New York Times reports, the Connected Car market is facing its own “VHS-or-Betamax Moment” reaching back to the early days of VCR rollouts that VHS eventually won. In the Connected Car industry, DSRC based on WiFi tech and supported by GM, Toyota and VW is competing with Cellular V2X based on next gen tech that is the choice of Ford, BMW, and Mercedes Benz. This is an important contest that can set baseline tech capabilities, but ultimately, experts expect everything to work together in the autonomous, connected car market.

Let’s hope for the same with ATSC 3.0 and 5G.

Industry Solution Sponsor

2adpro, a global technology enabled marketing services company, providing local media solutions in the following areas: creative production, digital campaign management and adtech workflow consultation.

2adpro, a global technology enabled marketing services company, providing local media solutions in the following areas: creative production, digital campaign management and adtech workflow consultation.

Questions? Please reach out to Pam Taylor, VP of North America at pam.taylor@2adpro.com.

This Post Has 0 Comments