It’s been quite a month! Banks are getting bailed out and bought out, interest rates are continuing to rise, and Princeton made it to the Sweet 16! All this uncertainty has significant impact on Advertising spending (yes, even the Tigers’ Cinderella run). Let’s dive in here and try to unpack what’s going on and what it will mean for certain key verticals in the upcoming months.

First, let’s talk about Silicon Valley Bank specifically, the “not too big to fail” bank that wouldn’t be allowed to fail. It’s interesting to note they were involved with many Northern California-based startups and tech companies.

This focus on riskier ventures certainly contributed to their collapse along with their investment concentrated in long-term assets with high-risk sensitivity to interest rate fluctuation, but what will this mean for the future of startups- especially in the tech sector?

Unfortunately, it doesn’t look good. Couple this bank failure news with all the recent layoff announcements in tech, and we can see that what used to be the Wild West of Opportunity is becoming much more competitive. I expect funding to get much tighter for those trying to start a new business venture which will mean fewer new product launches and competitors entering these spaces. At the end of the day, that all means less spending on Advertising as well.

It’s important to note though that what happens in Nor Cal is not necessarily indicative of what’s happening in the rest of the country. Even with SVB needing a bailout, The Fed still raised interest rates on March 22nd by a quarter point.

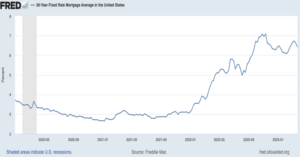

Before the announcement, consensus was that The Fed would either not touch rates or raise they by as much as a half a point. Leaving rates alone would have indicated The Fed felt the issues in the banking sector (past and future) would be enough to cool the economy and slow inflation to the levels they want. Raising rates by half a point (or more), would have indicated The Fed felt the economy was still too blazing hot and that they needed to continue to intervene. So, by choosing to increase rates by a quarter point, The Fed shows they are mindful of the banking hiccups, but also feels the economy is still too strong and that inflation will continue to be a problem unless they help to slow things down a bit. Also, this indicates The Fed believes the banking issues are behind us and that there isn’t more fallout to come. At the end of the day, this means interest rates are going to stay high for a while longer.

We know that’s going to affect Real Estate and Auto, but what’s very interesting is that we think these verticals will look very different from each other for the rest of 2023, even with the same driving forces (rising rates) behind them.

First, let’s have a look at Real Estate. With interest rates high compared to recent years and no indication that they are coming down anytime soon, Real Estate will continue to suffer. We have both a Supply and Demand problem here. Most people, when selling their home, are also looking to buy a new home. But, buying a home is difficult right now because of the high interest rates so most people will wait, if they can, to sell their home until they are in a better position to buy a new one.

With interest rates high and inventory very low, 2023 is not going to be a good year for Real Estate. (That’s especially unfortunate for me as I look to buy a place in Brooklyn this year… And, yes, I’m putting that fact in this blog so you can email me any leads you have!)

So then, looking at Auto, you’d expect the same murky picture as Real Estate for 2023. Interest rates are going up and, like Real Estate, Auto is closely tied to rates so this isn’t looking good, right? Actually, I feel pretty good about Auto advertising the rest of the year… Why? It’s a demand thing.

Think back about 18-24 months ago when interest rates were low. At that time, Real Estate was booming with people looking for more space and also relocating to other cities as working from home became more prevalent. Auto, on the other hand, was having significant supply chain issues and, therefore, they were not moving many cars. There was demand for new cars, but not enough supply. Essentially, the demand in Real Estate was being met, but the demand for Autos was not.

Fast forward to today. Now that we have higher interest rates, cars are less affordable for consumers, but we also have a ton of pent-up demand that has yet to be met. This is an opportunity! I am expecting to see an increase in Tier 3 spending by Auto Dealers touting financing deals to help move their inventory and cash in on the high demand. It won’t be an easy sell but remembering last month’s discussion on Split Brain Budgeting, Consumers are saving up to splurge on large ticket items such as that brand new car they’ve had their eye on for almost three years now… Auto Advertising will be focused on drawing in and enticing those Consumers to complete their purchases.

And, finally, back to those Princeton Tigers. Ad spend has been strong for the tournament this year with CBS and Warner Brothers Discovery bringing in more than their goal of $1 billion. And ratings were higher for Round 1 than ever before. But, as much as people say they love to watch an underdog win, that doesn’t show up in the ratings. Neither Fairleigh Dickinson (beating No. 1 Purdue) nor Princeton cracked the top five for Round 1 games. All this is a long way of saying I’m glad the Tigers lost. Not just because I’m a proud Penn Alum (GO QUAKERS!), but also for the good of the Adverting industry.

This Post Has 0 Comments