Over the air radio broadcasters find themselves in an increasingly competitive marketplace for both listeners and advertisers. Satellite delivered audio programming, podcasts, and internet streaming services and online and mobile apps all provide alternatives for entertainment and information and targeted advertising messages. Now, there’s evidence now that the revenue value of these alternatives has caught fire.

In a recently released study on the Syracuse, NY radio market area, BIA/Kelsey estimates reveal that local digital advertising revenue captured by major social media platforms such as Google, Facebook, and Bing combined ($40.5 million) exceeds the advertising revenue garnered by all of the local Syracuse radio stations ($32.5 million). In fact, Google’s share of the Syracuse advertising market ($29 million), by itself, will soon exceed the combined advertising revenue share of all over-the- air local radio stations ($30.2 million), as well as the share obtained by the digital platforms of these radio stations. The growth is coming from local advertisers who are increasingly using the advertising platforms and media that consumers are gravitating towards as new sources for news, information and entertainment.

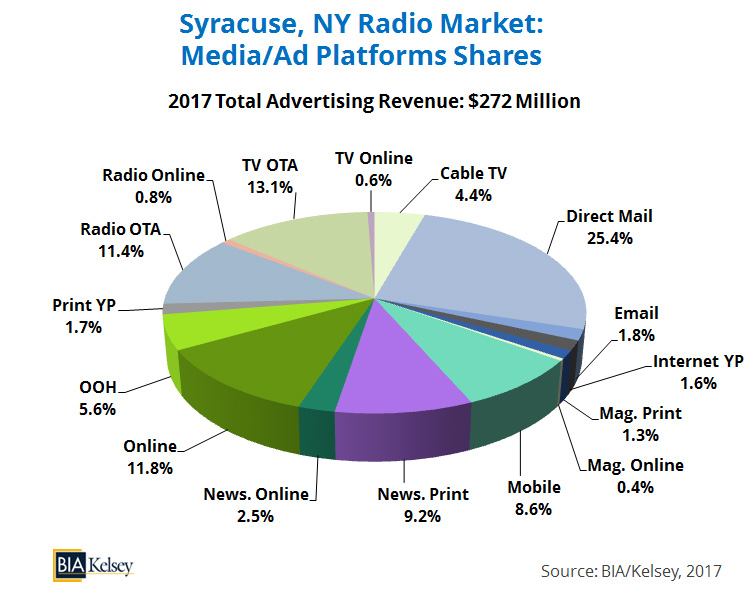

To get a sense of this wider marketplace in which local radio stations now competes, BIA/Kelsey’s 2017 estimates results depict the advertising shares of the various media/advertising platforms for the Syracuse, NY radio market.

The estimates reveal that local radio stations generate less than one-eight (11.4%) of the total local advertising revenue from their over-the-air broadcasts. On the other hand, other media like online and mobile are getting significant and increasing shares of this local advertising market. Online, representing the online sites not associated with traditional media properties, now attracts enough users to garner nearly one-eighth (11.8%) of the total advertising spending. In similar fashion, mobile sites and apps attracting a considerable usage by consumers now realize over one-twelfth (8.6%) of this advertising revenue. BIA/Kelsey forecasts new online/digital media are expected to experience double-digit growth over the next few years, indicating the increasing appetite for consumers to access news, information, and entertainment with these new media.

The situation in the Syracuse, NY radio market is not unusual. This scenario is occurring in markets of different sizes across the country. One opportunity to push back on competitive pressures from digital and social media platforms is to re-examine government policies that are designed to restrict common ownership of radio stations in local markets like Syracuse, NY. Relaxation of the local radio ownership rules is warranted not only in the largest markets, but in small and medium markets as well to give stations the opportunity to compete more easily. Allowing for increased economic efficiencies by expanding local radio market combinations in markets such as Syracuse, NY may also help ensure the economic vitality of the traditional free, over the air local radio stations.

This Post Has 0 Comments