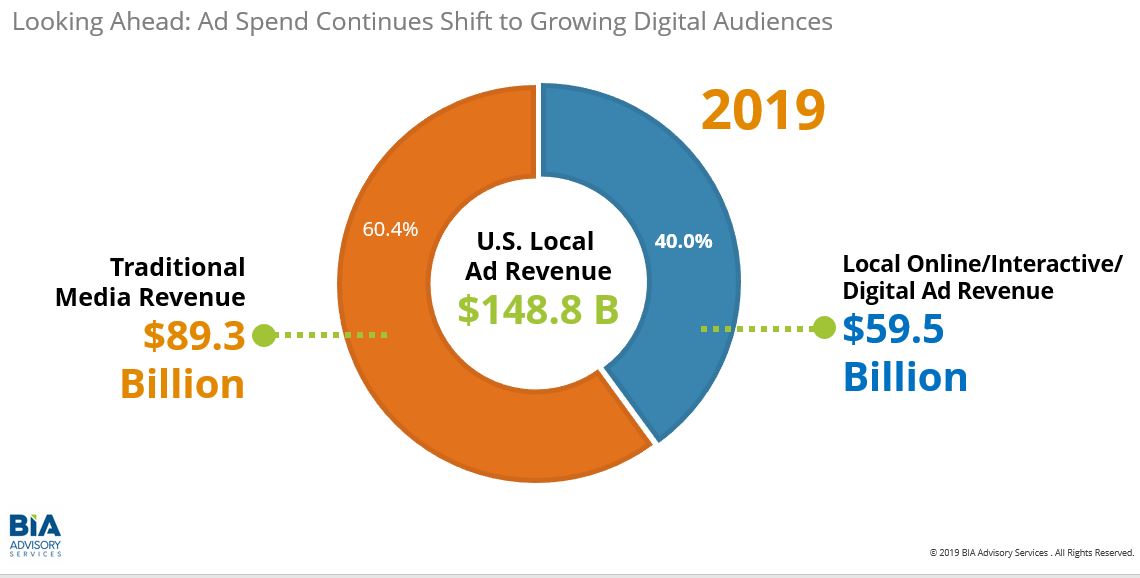

BIA’s mid-year forecast predicts that the 8 digital local ad platforms we track will generate $59.5 billion of the total $148.8 billion we expect advertisers to spend targeting local audiences. That is 40 percent of the total local ad spending. But BIA sees digital’s share rising to nearly half (49 percent) of all local ad spending by 2023. These “digital dollars” will total $82.5 billion. What does this mean for traditional media?

Traditional media, including radio, overall will decline by $3.5 billion in 2023. However, there are paths for traditional media to win back some of the local ad market share of wallet shifting to digital. Let’s consider the case of local radio.

Digital is a formidable competitor to the 8 traditional media local ad platforms in our forecast. Digital ad platforms offer data-driven audience targeting, attribution, targeting and retargeting across all types of devices and ad formats including full-motion video designed for the TV screen and fast-growing audio ad formats for smart speakers and connected cars.

As powerful as the value proposition is for digital’s local ad channels (e.g., mobile, social, in-stream/out-stream video, search, display, etc.), digital growth does not have to be unchallenged. In fact, BIA sees very interesting new competitive responsiveness from traditional media such as Local Radio.

Let me point to a recent interview BIA did with Jacobs Media Strategies, “How Radio Can Capture A Bigger Piece of the Revenue Pie.” Bottom line here is that radio needs to become more innovative and position itself as a multi-platform, full-funnel marketing solution that combines the power and reach of broadcast radio with newer innovations like attribution and geotargeting.

In another interview we did with Inside Radio’s Paul Hein, we considered that in a category like Auto where literally all of the increased ad spend is going to digital, there is still hope for local radio to come out a winner. As local radio increasingly provides attribution solutions to encourage buyers that their radio investments pay off, we see this adds a new element of competitiveness for radio.

Consider the case of the tier 3 auto dealer, the cost-efficiencies of digital with geotargeting make it very attractive and attribution dashboards help them plan, optimize and evaluate their campaigns. In a category like Auto, there can be a disincentive for tier 3 buyers when it comes to radio since they must buy the full radio market which leads to inefficiencies and “ad waste.”

Where all other major media including newspaper, outdoor, cable, digital, mobile, etc. can geotarget below the market level, radio cannot. Even local TV stations now have this capability with the new ATSC 3.0 standard currently in deployment. However, there is a technology that lets local radio stations operate geotargeted broadcast zones using new single frequency network technologies. But unlike the case with local TV stations, for some reason the FCC prohibits local radio stations from doing zoned broadcasting.

While there is support among local radio group executives for zoned broadcasting, the NAB and FCC appear to have too many other priorities to pursue this without a stronger voice of support from the industry. Curiously, there is some reason to believe the FCC may hear from the outdoor ad industry on zoned radio before they hear from broadcasters. Suffice it to say, the outdoor industry is not in favor of a more competitive radio industry.

To learn more about local radio and the opportunities of zoned broadcasting, please also see BIA’s work in this area (sponsored by GeoBroadcast Solutions).

This Post Has 0 Comments